The Essential Guide to Residency by Investment

- Melissa Gonçalves

- Oct 17, 2025

- 7 min read

More than 80 countries now offer residency by investment programs, giving investors a powerful way to secure global mobility and new economic opportunities. For many, these programs mean more than just moving—they promise access to better healthcare, education, and security in an ever-changing world. Understanding how each program works, what standards matter, and which benefits are real helps future residents make smart and strategic choices for themselves and their families.

Key Takeaways

Point | Details |

Residency by Investment | This strategy enables high-net-worth individuals to obtain legal residency in exchange for significant financial contributions, emphasizing careful planning and alignment with personal goals. |

Investment Varieties | Programs typically offer options such as real estate, business investments, and national development contributions, each with unique benefits and requirements. |

Risks and Compliance | Investors must be aware of potential financial, regulatory, and hidden costs associated with these programs, necessitating thorough documentation and proactive management. |

Long-term Benefits | Beyond legal status, residency by investment provides access to superior healthcare, education, tax optimization, and enhanced global mobility, making it a comprehensive lifestyle investment. |

Table of Contents

Residency By Investment: Core Principles Explained

Residency by investment programs represent a strategic pathway for global investors seeking to establish legal residency in a new country through significant financial contributions. Investment migration has emerged as a sophisticated approach allowing high-net-worth individuals to secure international mobility, economic opportunities, and enhanced lifestyle options through carefully structured investment channels.

According to the Investment Migration Council, these programs are designed with rigorous standards and ethical frameworks that protect both investor interests and host country economic objectives. The core principles typically involve:

Substantial financial investment into the host country’s economy

Comprehensive background and compliance checks

Clear legal pathways to residency or citizenship

Transparent investment requirements

Regulated financial mechanisms

Understanding these programs requires recognizing they are not merely financial transactions, but strategic life decisions. Our comprehensive guide on EU residency options offers deeper insights into how investors can strategically approach these complex international mobility solutions. Successful participation demands careful planning, understanding individual eligibility criteria, and aligning personal goals with specific program requirements.

The ultimate value of residency by investment extends beyond immediate financial considerations. These programs offer investors and their families profound benefits: access to superior healthcare systems, world-class education opportunities, enhanced global mobility, potential tax optimization strategies, and a robust Plan B for personal and professional security in an increasingly unpredictable global landscape.

Major Program Types and Key Differences

Residency and citizenship by investment programs represent complex international mobility strategies with significant variations in structure, requirements, and outcomes. According to research from Global Citizens Solutions, these programs fundamentally differ across multiple critical dimensions, creating unique pathways for global investors seeking international mobility.

According to Wikipedia’s overview of immigrant investor programs, two primary program categories emerge:

Residency-by-Investment Programs:

Provide legal residency status

Typically require continuous investment

Often lead to potential naturalization after several years

Include investment options like real estate, funds, business creation

Citizenship-by-Investment Programs:

Offer direct citizenship pathway

Faster route to full legal status

Generally require larger financial investments

Provide immediate passport and international mobility

Explore our detailed guide on Golden Visa alternatives to understand the nuanced landscape of investment migration. European countries like Portugal, Greece, Spain, Cyprus, and Latvia each offer unique programs with distinct minimum investment requirements, processing timelines, and renewal regulations.

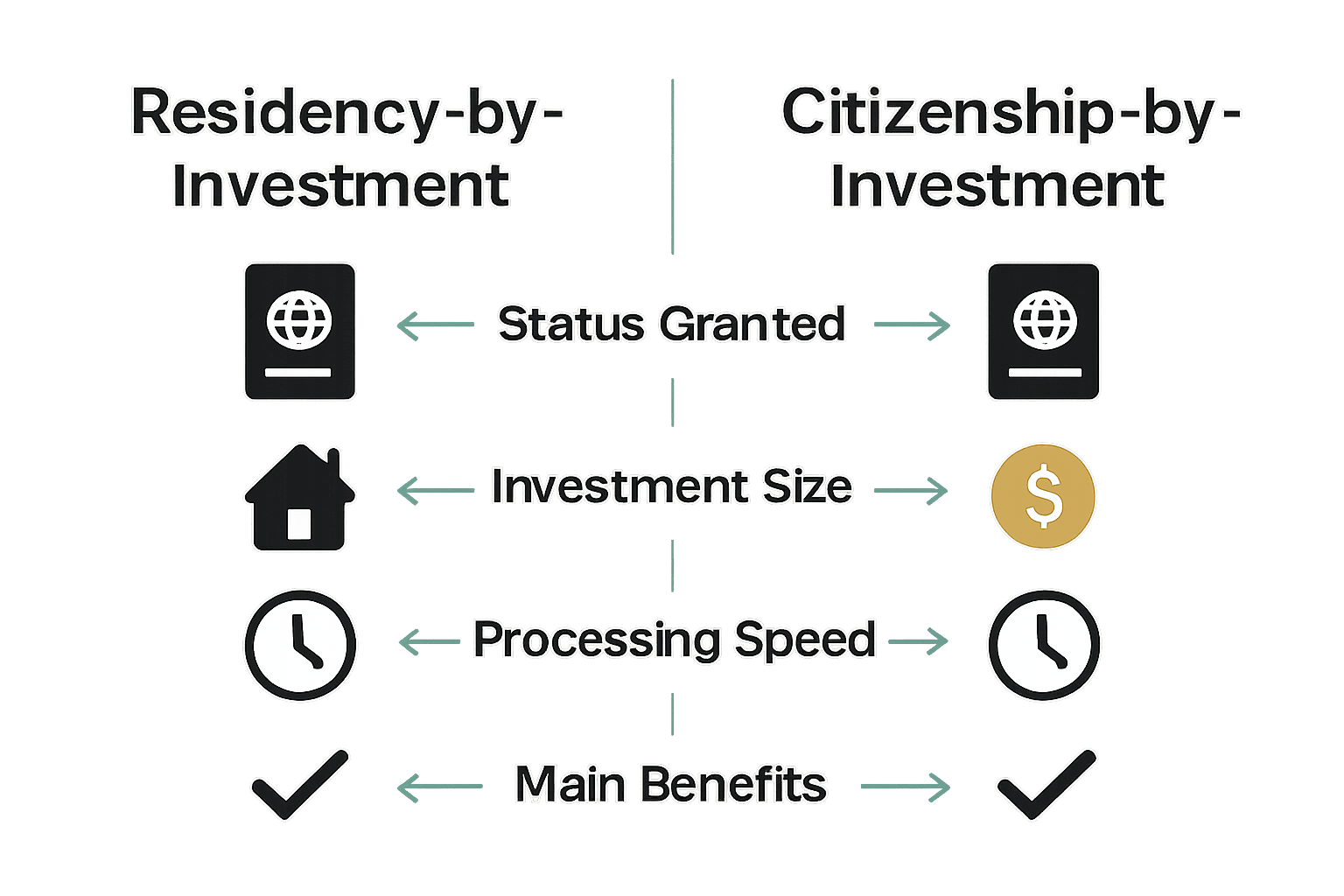

Here’s a comparison of residency-by-investment and citizenship-by-investment programs:

Program Type | Residency-by-Investment | Citizenship-by-Investment |

Status Granted | Legal residency | Full citizenship & passport |

Investment Size | Lower (e. |

g., €250,000+) | Higher (often €500,000+) | | Processing Speed | Several months to years | Often faster (months) | | Pathway to Naturalization | Usually, after years | Immediate or none needed | | Typical Investment Options | Real estate Funds Business creation | National funds Qualifying real estate | | Travel/Benefits | Regional mobility Healthcare & education | Global mobility Full citizen rights |

Successful navigation of these programs demands sophisticated understanding. Investors must carefully evaluate personal objectives, financial capacity, long-term goals, and specific program intricacies to select the most appropriate international mobility strategy that aligns with their individual family and professional needs.

Eligibility Criteria and Legal Requirements

Investment migration programs require meticulous attention to legal and personal prerequisites that go far beyond simple financial transactions. According to research from Global Citizens Solutions, each jurisdiction establishes comprehensive eligibility criteria designed to ensure the integrity and security of their residency and citizenship pathways.

The foundational legal requirements typically encompass several critical dimensions:

Personal Prerequisites:

Minimum age of 18 years

Valid international passport

Demonstrable clean criminal record

Comprehensive health insurance coverage

Proof of legitimate financial resources

Financial and Compliance Standards:

Minimum investment thresholds

Verifiable source of investment funds

No outstanding tax liabilities

Successful completion of due diligence checks

Continuous compliance with investment maintenance rules

Our comprehensive guide on residency visas provides deeper insights into navigating these complex requirements. While standard criteria exist, investors must recognize that each country implements unique interpretations and additional nuanced conditions that demand specialized understanding and strategic preparation.

Successful applicants understand that meeting eligibility criteria is not merely a checkbox exercise, but a sophisticated process of demonstrating personal and financial credibility. The intricate legal framework surrounding investment migration requires investors to approach these programs with comprehensive documentation, transparent financial histories, and a commitment to ongoing compliance with host country regulations.

Qualifying Investments and Fund Options

Investment migration programs offer sophisticated pathways for global investors to secure residency through strategic financial contributions. According to research from Global Citizens Solutions, qualifying investments represent a diverse ecosystem of financial instruments spanning multiple investment categories and strategic objectives.

The primary qualifying investment options typically include:

Direct Capital Investments:

Real estate acquisitions

Business venture investments

Public debt instruments

Share capital contributions

Venture capital funds

Specialized Investment Channels:

Donations to national development funds

Cultural heritage preservation contributions

Research and development investments

Government-approved investment funds

Our comprehensive guide on investment fund strategies provides deeper insights into navigating these complex investment landscapes. Investors must carefully evaluate each option’s specific requirements, potential returns, liquidity considerations, and alignment with personal financial goals.

Successful investment migration strategies demand a nuanced understanding of each jurisdiction’s unique regulatory framework. While investment amounts typically range from €250,000 to significantly higher thresholds, the true value lies in selecting options that not only meet legal requirements but also represent sound financial planning aligned with long-term personal and professional objectives.

Risks, Costs, and Common Pitfalls

Investment migration represents a complex financial strategy that demands sophisticated understanding beyond surface-level attractions. Navigating these programs requires investors to meticulously assess potential risks, comprehensive costs, and strategic challenges that could significantly impact their long-term objectives.

Investors must carefully evaluate several critical risk dimensions:

Financial Risks:

Potential loss of initial investment capital

Market volatility affecting fund performance

Currency exchange rate fluctuations

Limited investment liquidity

Unexpected taxation consequences

Regulatory Risks:

Potential program policy changes

Shifting legal requirements

Compliance documentation challenges

Unexpected due diligence complications

Potential rejection without clear explanation

Our comprehensive guide on Golden Visa alternatives offers deeper insights into mitigating these complex risks. Strategic investors recognize that successful participation requires more than financial resources—it demands comprehensive legal understanding, meticulous documentation preparation, and proactive risk management approaches.

Beyond financial considerations, investors must also anticipate substantial hidden costs: extensive legal consultations, document authentication expenses, professional translation services, potential relocation costs, and ongoing compliance management. The most successful investment migration strategies are those that view these programs not as transactional processes, but as holistic, long-term personal and financial planning initiatives requiring patience, strategic thinking, and expert guidance.

Residency Rights, Benefits, and Next Steps

Investment migration residency transforms from a financial transaction into a strategic life-changing opportunity that extends far beyond mere legal documentation. Successful investors understand that obtaining residency represents a comprehensive pathway to personal and professional transformation, offering multifaceted advantages that redefine global mobility and personal freedom.

The primary benefits of investment migration residency encompass several critical dimensions:

Personal Mobility Advantages:

Unrestricted travel within designated regions

Potential pathway to permanent residency

Access to superior healthcare systems

Educational opportunities for dependents

Enhanced global lifestyle flexibility

Financial and Professional Benefits:

Tax optimization strategies

Business expansion opportunities

Investment portfolio diversification

Protection of family wealth

Alternative economic environments

Our comprehensive guide explores permanent residency motivations to provide deeper context for potential investors. Strategic next steps involve meticulously planning your transition, understanding specific program requirements, and developing a holistic approach that aligns with long-term personal and financial objectives.

Ultimately, investment migration residency is not merely about changing geographic location, but about creating a sophisticated, flexible lifestyle strategy. Successful participants view this process as a calculated investment in personal potential—a nuanced approach to designing a more secure, dynamic future for themselves and their families by strategically expanding their global opportunities.

Your Path to Secure EU Residency Starts Here

Have you been weighing the risks and complexity of residency by investment programs, especially when market volatility, due diligence, and long-term security are at stake? If the concern about real estate exposure, opaque investment options, or legal uncertainty is holding you back, then it is time to reimagine your approach. At MFG Consultants, our expertise connects your financial and lifestyle goals with the safest and most transparent solutions tailored for discerning investors like you. Unlock direct access to a curated portfolio of EU-compliant investment funds, each rigorously vetted for the Portuguese Golden Visa and broader EU residency strategies. Discover options that go beyond traditional real estate and protect your wealth while streamlining your journey to EU residency.

Take control of your international mobility with confidence. Visit MFG Consultants to explore our unique approach and how our investment fund strategies or guide to EU residency options can bring you clarity, financial security, and peace of mind. Act now to secure your future and protect your family in an unpredictable world. Connect with our specialists today and start mapping your next move.

Frequently Asked Questions

What is residency by investment?

Residency by investment is a program that allows individuals to obtain legal residency in a country by making significant financial contributions, such as investments in real estate, businesses, or government funds.

What are the main types of investment migration programs?

The two primary types are residency-by-investment programs, which grant legal residency status, and citizenship-by-investment programs, which provide a direct pathway to citizenship and a passport.

What are the eligibility criteria for investment migration programs?

Eligibility typically includes a minimum age of 18, a valid passport, a clean criminal record, proof of financial resources, and health insurance coverage, along with specific investment requirements.

What are some common risks associated with residency by investment?

Common risks include potential loss of the initial investment, market volatility, regulatory changes, compliance issues, and hidden costs for legal advice and documentation.

Recommended

Comments